Average Collection Period calculator online Activity ratios

Content

- Importance of the Average Collection Period

- Example of the Average Collection Period

- How Do You Calculate the Average Collection Period Ratio?

- How Can a Company Improve its Average Collection Period?

- What Is Average Collection Period?

- What Are the Limitations of Using the Average Collection Period Ratio?

Some construction Average Collection Period Calculator And Formula balance their short and long term projects to improve their average collection period. While most companies figure average collection periods over the entire business year cycle, some also break it down into quarters or other periods. This is why it is important to know how to find average accounts receivable for other collection periods as well.

- Second, doing the average collection period analysis helps a company decide the means to collect the money due to the market.

- The average collection period must be monitored to ensure a company has enough cash available to take care of its near-term financial responsibilities.

- For example, if you impose late payment penalties on a relatively short period, say, 20 days, then you run the risk of scaring clients off.

- For calculating Average collection period, we need the Average Receivable Turnover and we can assume the Days in a year as 365.

- This gives deeper insight into what other companies are doing and how a company’s operations compare.

The measure is best examined on a trend line, to see if there are any long-term changes. In a business where sales are steady and the customer mix is unchanging, the average collection period should be quite consistent from period to period. Conversely, when sales and/or the mix of customers is changing dramatically, this measure can be expected to vary substantially over time. So, now you know how to calculate the average collection period, you need to understand what the resulting figure means. Most companies expect invoices to be paid in around 30 days, so anything around this figure should be considered relatively normal. Any higher – i.e., heading into 40 or more – and you might want to start considering the cause. This is a good number for the car lot because it is less than the one year they ask customers to pay off the credit.

Importance of the Average Collection Period

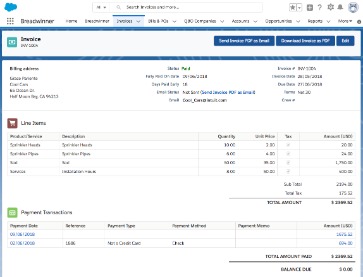

Using those assumptions, we can now calculate the average collection period by dividing A/R by the net credit sales in the corresponding period and multiplying by 365 days. There are three ways to use the Average Collection Period ratio to monitor the efficiency of accounts receivables collections. You can compare the ratio to previous years’ ratios, compare it to your current collection terms, or compare it to competitors’ terms. Knowing a company’s average collection period ratio can help determine how effective its credit and collection policies are.

You may link to this calculator from your website as long as you give proper credit to C. C. D. Consultants Inc. and there exists a visible link to our website. Calculate monthly collection period from the following information . With the best trading courses, expert instructors, and a modern E-learning platform, we’re here to help you achieve your financial goals and make your dreams a reality. We have been producing top-notch, comprehensive, and affordable courses on financial trading and value investing for 250,000+ students all over the world since 2014. The first formula is mostly used for the calculation by investors and other professionals. For calculating Average collection period, we need the Average Receivable Turnover and we can assume the Days in a year as 365.

Example of the Average Collection Period

That means the average accounts receivable for the period came to $51,000 ($102,000 / 2). A combination of prudent credit granting and robust collections activity is indicated when the DSO figure is only a few days longer than the standard payment terms. The average collection period should be closely monitored so you know how your finances look, and how this impacts your ability to pay for bills and other liabilities. There’s a big difference between knowing you’re due to be paid $10,000 and safely having it in your business bank account. If you allow various types of credit transactions, then the average collection period MUST be also calculated separately for each category. Jason is the senior vice president of Bill Gosling Outsourcing’s offshore location in the Philippines.

What is the average collection period for accounts receivable assuming a 365 day calendar year?

Since there were 365 days during the recent year, the average collection period is 365 days divided by the turnover ratio of 10 = 36.5 days.

The former expresses no. of https://intuit-payroll.org/s debtors are converted into cash in a financial year, whereas the latter gives no. of days or months in which the debtors are converted into cash. The Average Collection Period ratio is the average amount of time it takes for a business to collect its receivables. In other words, it tells you the average number of days it takes for clients to pay their invoices or, more importantly, how long it takes to get cash for your outstanding accounts receivables. The accounts receivable collection period compares the outstanding receivables of a business to its total sales. This comparison is used to evaluate how long customers are taking to pay the seller.