PayPal Accounting Software Accounting for PayPal Transactions

Contents:

Beginning with the 2023 tax season, you will receive a 1099-K from PayPal for over $600 in payments for goods and services on the platform. One of the best practices for small businesses to implement when using PayPal for accounting purposes is to utilize its invoicing feature to create professional invoices. This feature offers business owners an opportunity to create customized and branded invoices with their company logo and payment details easily accessible for customers.

What Is Facebook Pay and How Does It Work? – businessnewsdaily … – Business News Daily

What Is Facebook Pay and How Does It Work? – businessnewsdaily ….

Posted: Tue, 21 Feb 2023 08:00:00 GMT [source]

In today’s world of digital payments, Venmo and PayPal are two of the most popular online payment services. While they both offer similar services, there are times when you may need to transfer money from Venmo to PayPal or vice versa. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site.

About This Article

If that client issues a 1099-NEC for $20,000 on top of the 1099-K issued to the IRS by PayPal, it will appear to the IRS as though the consultant earned $40,000. In this situation, the consultant will now appear to owe taxes on $40,000 of revenue, even though they only earned $20,000. In such a situation, the consultant should report the actual revenue they earned, and have the paperwork to support this figure.

PayPal Software Reviews, Demo & Pricing – 2023 – Software Advice

PayPal Software Reviews, Demo & Pricing – 2023.

Posted: Sat, 30 May 2020 08:37:10 GMT [source]

No single credit card is the best option for every family, every purchase or every budget. We’ve picked the best credit cards in a way designed to be the most helpful to the widest variety of readers. All three companies offer instant transfers of your balance to your bank account. Sending money to family or friends in the U.S. via a bank account or PayPal balance. PayPal Credit allows qualifying users to shop for an item online and pay for it later or over time with interest (23.99%) — acting basically like an online credit card.

Read our comprehensive PayPal review to decide if it’s the right option for your company. No, you cannot send money directly from PayPal to Venmo. The same company owns PayPal and Venmo but operates as separate payment platforms with unique features and services. Paypal is the biggest digital payment platform used by businesses and people to carry out personal and business transactions. PayPal is one of the most commonly used payment processing platforms, which makes it a go-to for customers and merchants alike.

Reasons Why Venmo Payment Declining? How To Fix Venmo Transaction Declined?

But if you want a full-california income tax rate banking experience, using PayPal as your bank account may not provide the range of services and tools you need. Venmo is a mobile payment service that allows users to send and receive money from their friends and family. It was launched in 2009 and has gained immense popularity among younger generations. Venmo works by linking your bank account or credit card to your account, allowing you to transfer money to other users. PayPal is online payment software for sending and receiving money.

Accounting is essential to the success of a business, whether big or small. With various platforms available for online transactions, PayPal has become a popular choice for many small businesses. It offers a smooth and secure way to send and receive payments, and it also provides accounting tools to help you manage your finances. However, with great financial tools come great responsibilities, and it is crucial to follow best practices when using PayPal for accounting purposes.

Do You Need a Bank Account for PayPal?

More than 300 million people and businesses worldwide use PayPal to send money, receive money and shop online. Along with digital payments, PayPal offers other financial services like debit cards, prepaid cards, credit cards and lines of credit. If you don’t already have a checking or savings account, you may be considering using PayPal as your everyday banking solution. After all, PayPal offers convenience and a digital-first experience.

Transfer your remaining balance to your other PayPal or bank account, or contact customer service to have a check issued for the remaining balance. For security, we’ll occasionally ask you to log in, including every time you update your personal or financial info. Use PayPal Checkout to easily accept payments online or in-store.

Important steps to take before you delete your PayPal account

This article was written by Hannah Cole and by wikiHow staff writer, Nicole Levine, MFA. Hannah Cole is an Enrolled Agent and the Founder of Sunlight Tax. She has her Enrolled Agents license, which is a tax expertise and representation credential issued by the IRS. She has been hosted to speak about taxes for artists by institutions including the Harvard Ed Portal, the Boston Foundation, the New York Foundation for the Arts, RISD, and Cornell University. Hannah received her BA in Art History from Yale University, MFA in Painting from Boston University, and studied accounting at Brooklyn College. If you chose to link a bank account or have a bank-issued debit or credit card, check to see if your bank is listed. You can use the search bar to search for it by name if you don’t see its logo.

PayPal offers businesses a range of solutions for their day-to-day operations. This includes payment portals for online and in-person transactions, business management services, and credit and financing options. Business owners must also provide an email address in order to create an account.

PayPal vs. Venmo and Cash App

By doing so, businesses can keep accurate financial records, track cash flow, and simplify tax reporting. A business account is a bank or credit account dedicated solely to your business finances. While transferring money directly from Venmo to PayPal may not be possible, transferring funds between the two platforms is still possible. You can easily move money between the two platforms by connecting your PayPal account to Venmo and transferring funds through your bank account. Double-check the recipient’s information, add a note, and be mindful of any fees and limits. With these tips, you can safely and efficiently transfer funds between Venmo and PayPal.

- Once the funds are in your bank account, you can transfer them to your Venmo account.

- PayPal is rated one of our top 10 point-of-sale systems for 2023.

- However, if you are using login credentials that you also use elsewhere, you are advised to change to unique and strong passwords at all those services.

- Find the perfect fit with a team and role that suits your skills.

One thing to keep in mind is the difference between selling goods and https://1investing.in/ for profit and selling casually as a hobby. When you have a physical garage sale from your home, that income is not considered part of your gross income, making it non-taxable. This same rule can apply to certain income received through PayPal if you’re using the platform for “garage sale” transactions.

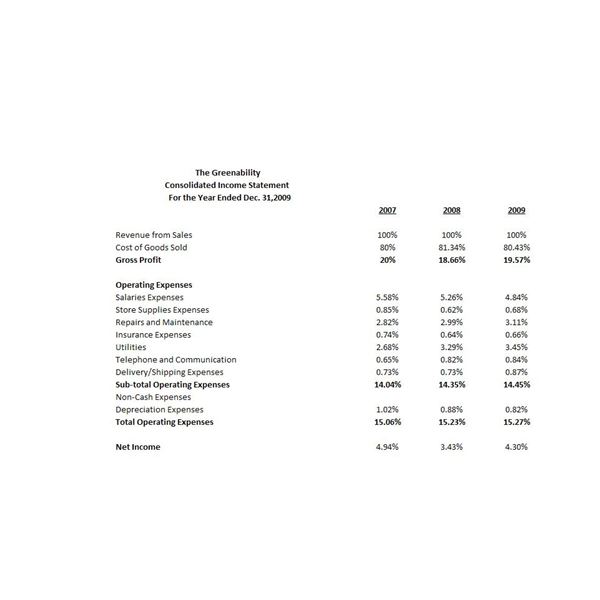

Its advantages to a merchant include great ease of use and access to a range of additional features that can help you run a small business. PayPal broke into the mainstream as the preferred payment mechanism for eBay buyers and sellers. The auction site decided to acquire PayPal in 2002 and made it the site’s official payment service while working to expand its reach. PayPal makes much of its revenue from fees it charges merchants, rather than from the consumers who pay with it. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. Record all PayPal transactions in your accounting system.

Avoid interest by paying off the full amount in six months on purchases of $99 or more. To make a purchase or transfer money domestically using a bank account or your PayPal balance. This form is sent by third-party payment networks like PayPal and Venmo to any users meeting the requirements for the related tax year. You are responsible for filing either a Schedule C or Schedule E along with Form 1040, depending on your business structure. For example, a consultant may invoice a client via PayPal for services provided.

The 7 Most Undervalued Stocks to Buy in April 2023 – InvestorPlace

The 7 Most Undervalued Stocks to Buy in April 2023.

Posted: Wed, 05 Apr 2023 10:36:51 GMT [source]

A graduate of Rice University, he has written for several Fortune 500 financial services companies. If you have a track record of having your bank account closed or other bad marks on your banking history, you may want to apply for a second chance banking account. These accounts, offered by some banks and fintechs, help people get a fresh start in banking. Once you have a PayPal Cash Card, PayPal will begin to deposit your funds into a pooled account held by PayPal at an FDIC-insured bank.